SMOKING will be banned in all indoor public venues and workplaces in Shanghai from March next year. The ban will cover hotels, restaurants, offices, airports, railway stations and entertainment venues after a new smoking regulation was approved by the Shanghai People’s Congress Standing Committee yesterday.

Under the new regulation, hotels cannot have rooms designated for smoking, and restaurants and entertainment venues will not be allowed to have smoking areas.Smoking will also be banned in government agencies’ offices, meeting rooms and canteens. Airports, railway stations, ferry ports and bus stations will have to shut down smoking rooms currently in use.

The new regulation also extends the smoking ban in outdoor areas to public venues for minors, such as primary schools, kindergartens and training institutes, children’s hospitals, historic venues, stadiums and public transport waiting areas. Performance areas such as stages and audience areas will also be smoke-free.

“The regulation aims to take a stricter control on smoking and extend the smoking ban areas to protect the public from second-hand smoking,” said Ding Wei, deputy director of the congress’s legislation department.

The current regulation, introduced in 2009 ahead of the 2010 World Expo in Shanghai, stipulated that star-rated hotels, restaurants, airports, railway stations and ferry terminals could set up smoking areas or smoking rooms. Hotels were allowed to categorize rooms as smoking or non- smoking. China has accelerated a campaign against smoking over the past year, setting to raise the wholesale tax rate for cigarettes to 11 percent from 5 percent, and banning tobacco ads in the mass media, public places, on public transport and outdoors.

The new regulation does allow for smoking areas to be set up near public venues, workplaces and transport hubs, Ding said.However, they must be away from the public and major passageways and have signs-warning that smoking is harmful to health.They will also have to be approved by the city’s fire prevention authority. Fines for breaches of the new rule are unchanged at 50-200 yuan (US$7-US$29) for individuals and up to 30,000 yuan for companies.

Law enforcement officers can fine individuals and companies on the spot if anyone is caught smoking in no-smoking areas. The new rule also encourages the public to send pictures of offending behavior to the 12345 hotline. Owners of public venues will be required to ask customers to stub out their cigarettes. If customers refuse, owners can provide evidence and report offenses to law enforcement agencies, otherwise they will face fines of up to 30,000 yuan.

“Apart from the stricter regulations, we also take the feasibility of the rules into consideration,” Ding said.Under the new rule, “the city government can make stipulations on setting up indoor smoking rooms under special circumstances,” Ding said.

Indoor smoking rooms are necessary, for instance, at companies or factories where naked flames are banned outdoors. He said companies setting up indoor smoking rooms would have to get prior approval. Indoor smoking rooms have been closed at Shanghai’s Pudong and Hongqiao international airports as well as the city’s railway stations. Outdoor smoking areas have been set up at these places.

Source: http://www.shanghaidaily.com/metro/society/Stricter-smoking-ban-from-March/

The new smoking ban in Shanghai restricts the use of most smoking rooms and the act of smoking in more open areas such as kindergartens. Shanghai has already set regulations to ban indoor smoking. Besides, last year, the government raised the tax rate for cigarettes from 5 percent to 11 percent, and banned ads in the media and public places.

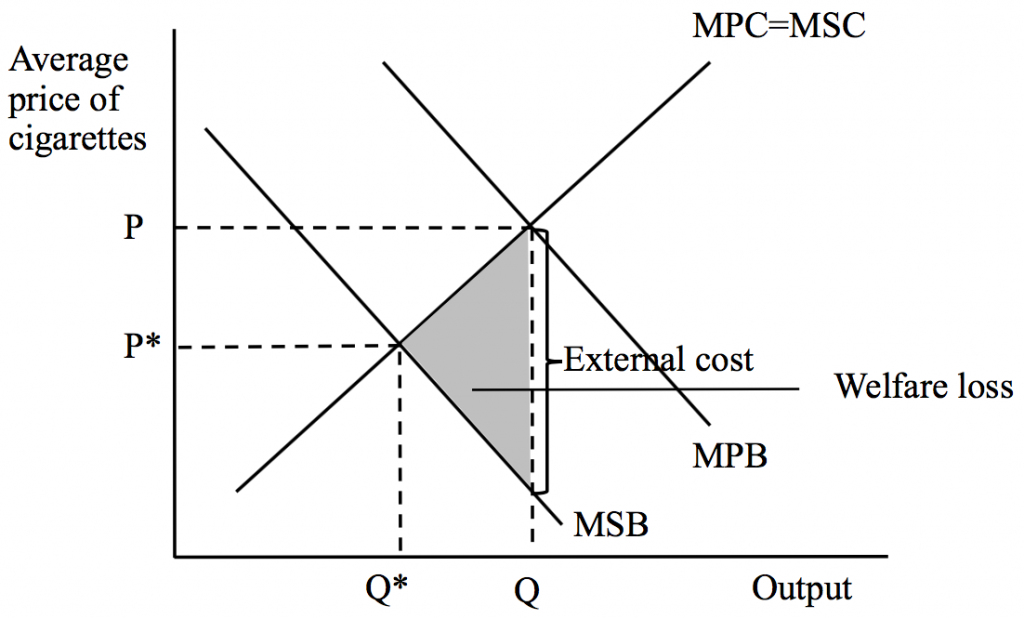

Cigarettes are demerit goods whose consumption is socially undesirable due to the perceived negative effects. Cigarettes have significant negative externalities, the side-effect on the people who did not incur that effect. The consumption leads to people around who are not directly involved suffering from health problems caused by second-hand smoking. The cigarette market represents a market failure which overproduces the amount of output that the society needs where the community surplus is maximized. Cigarettes are over consumed and produced. This is shown in Diagram 1. The actual quantity consumed (Q) is higher than the optimal quantity (Q*). The vertical between MPB and MSC shows the external cost paid by the society instead of the individuals who cause the externalities.

Diagram 1

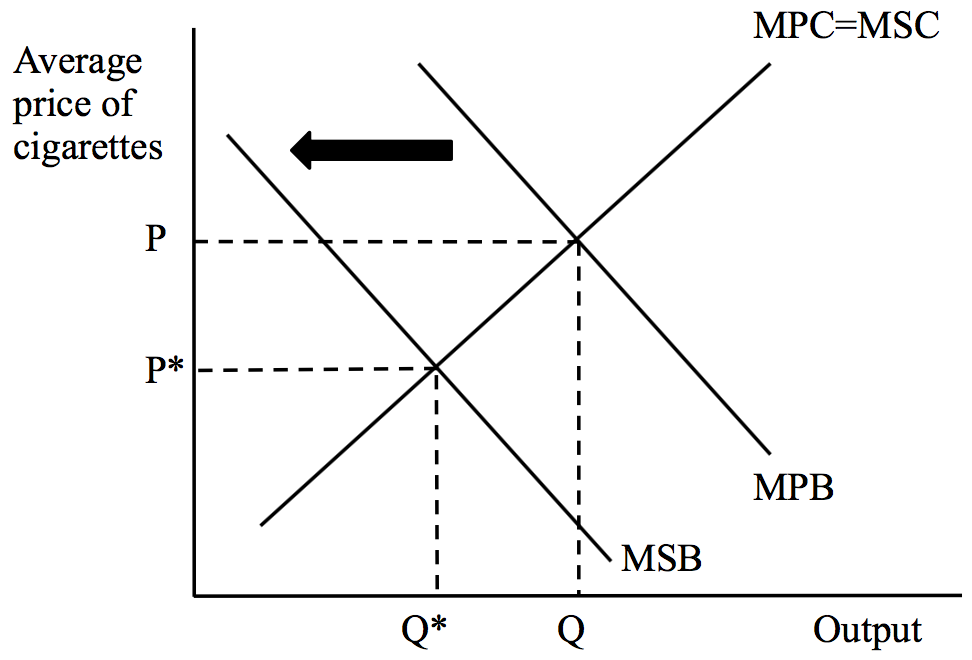

Banning smoking rooms or ads and making fines are government regulations used to reduce consumer demand, shifting the demand (MPB) curve to the left, and decreasing the quantity consumed from Q to the optimal level (Q*). This is shown in Diagram 2. However, government regulations mean high cost. For example, the labor cost of hiring someone to enforce these laws in public places are expensive. This may cause a pressure on the government’s budget. In addition, the opportunity cost of setting these regulations should also be taken into consideration. The money used to hire people may be used to build new public facilities instead. Also, the regulations may not have great effect if the laws are not strict enough.

Diagram 2

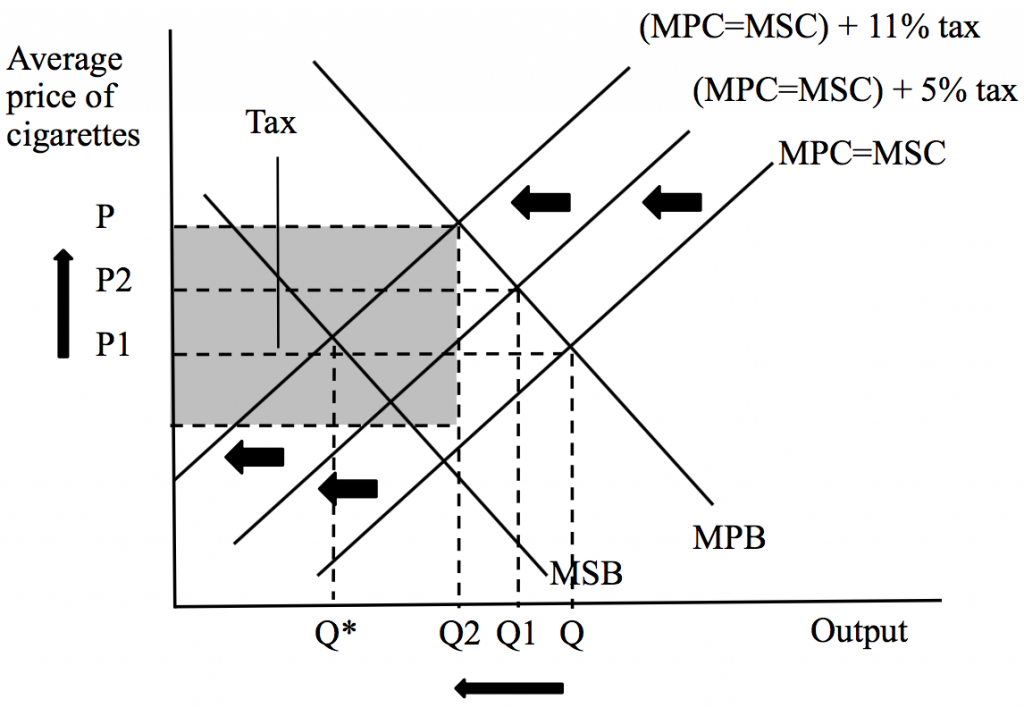

Taxation is an easy and common market-based policy to reduce negative externalities. Taxes increase the cost of production of cigarettes, reducing the supply, and eventually raising the price of cigarettes. Ceteris paribus, the demand of cigarettes decreases, showing a movement along the demand curve. Now we set that the previous market equilibrium starts from output Q and price P1. The previous 5% wholesale tax on cigarettes has already shifted the supply curve from the market equilibrium to the left. Now the new 11% tax will further decrease the supply and shift the supply curve to the left. As a result, the price of cigarettes now rises to even higher P, and the output is reduced to quantity Q2, getting even closer to the optimal quantity. This is shown in Diagram 3.

Diagram 3

However, taxation also has some difficulties.

The price elasticity of demand, measuring the responsiveness of the quantity demanded of cigarettes, is quite low. The quantity demanded only changes a little when the price changes in a higher rate. Smoking is a habit, and the spending of cigarettes is only a small proportion in people’s income. So, people will continue to buy as many cigarettes as before when the tax rises. To make sure the tax is effective to discourage smoking and achieve Qopt, it must be set extremely high, which is unacceptable because most cigarette buyers are the poorer people, and if they continue to buy, most tax will be paid by the poor but not the rich, causing more income inequality. Generally, the new 11% tax may not work well in reducing negative externalities because the rate is still not high enough to force people give up smoking.

In addition, the tax rate is difficult to set appropriately because the value of negative externalities is hard to determine. It is hardly possible to measure how much the consequences such as health problems will cost. Whether the tax rate is reasonable for helping correct externalities is unknown.

Furthermore, the reducing demand and the rising price of cigarettes will definitely decrease cigarette output, lowering firms’ profits. Workers are more likely to lose their jobs if the firms cut workforce. As a result, the unemployment rate may increase. And the unemployment pension paid to the workers will exert a pressure on the government’s budget.

In conclusion, the government should evaluate different costs and consequences of every new regulation and market-based policy for discouraging cigarettes. There is no doubt that it is impossible to turn the cigarette market into a perfectly optimum level, but the government can try their best to internalize the MSB and MPB to reduce as many negative externalities as they can.