The Russian central bank lowered its key interest rate by 0.25 percentage points to 9.75 percent on Friday, citing lower inflation and economic recovery.

“The Board of Directors notes that the inflation slowdown overshoots the forecast. Inflation expectations continue to decline and economic activity recovers,” the bank said in a statement. The Russian central bank has lowered its key interest rate by 0.5 percentage points to 10.5 percent in June 2016 in a first reduction since August 2015 and further cut it to 10 percent in September.

The central bank said Friday that Russia’s year-on-year consumer price growth slowed down to 4.3 percent in the first 20 days of March from 5 percent in January.

Russia’s inflation hit a record low of 5.4 percent in 2016, sharply recovering from 12.9 percent in 2015. The target set for 2017 is 4 percent.

The inflation slowdown was broadly facilitated by the rise of the ruble on higher-than-expected oil prices and the continued interest of foreign investors in Russian assets, the central bank said.

Bumper harvests of 2015-2016 have resulted in high stocks of agricultural products, leading to a material slowdown in food, vegetable and fruit prices, it added.

The pace of Russia’s economic recovery was also quicker than previously expected, the statement said, citing growing industrial output in the first two months of 2017 and a gradual rebound in investment activity.

The central bank expected Russia’s GDP to grow 1-1.5 percent this year and by 1-2 percent in 2018-2019 considering the current dynamics of the recovery and higher economy resilience to fluctuations in external economic environment.

The Russian economy began to contract in 2014 mainly due to weak oil prices and Western sanctions over Russia’s alleged involvement in the Ukraine crisis.

Official data showed that Russia’s GDP fell by 0.2 percent year-on-year in 2016, compared to a 2.8-percent decline in 2015.

(Source: http://english.sina.com/news/2017-03-24/detail-ifycsukm3522531.shtml)

The Russian central bank lowered its interest rate to 9.75 percent recently, and this was not the first time in recent two years. The central bank has lowered its interest rate to 10.5 percent in June 2016 since August 2015 and further cut the rate to 10 in September. The bank said the reduction would help the inflation rate of Russian economy back to target. The Russian economy is experiencing an inflation, a general increase in price level.

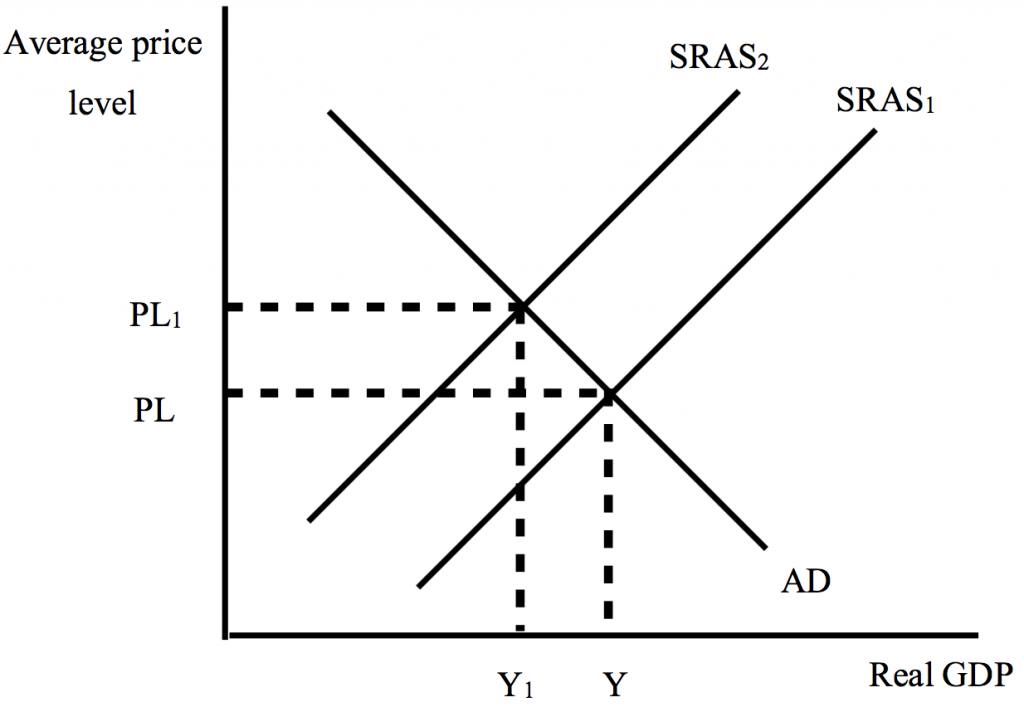

The current inflation in Russia is mainly due to high oil prices, according to the news. Oil is crucial to every economic activity. Therefore, an increase in oil prices leads to a rise in cost of production, shifting the short-run aggregate supply to the left (from SRAS1 to SRAS2). This is shown in Diagram 1. Aggregate supply is the total amount of goods and services an economy can produce at each price level.

Diagram 1

This leads to an increase in general price level (from PL to PL1) and a decrease in real GDP (from Y to Y1). This kind of inflation is regarded as a stagflation, a negative combination of recession and rising price level. Consumers with fixed wages may lose buying power due to the high inflation as now the goods and services are at higher prices, but their wages have not risen. For people who has large savings, their value of deposits may decrease. All these lead to people’s low willingness to buy, and therefore cause an insufficient aggregate demand. Fortunately, according to the news, thanks to the increasing high interest from foreign investors in Russia, the foreign trades have not been significantly affected.

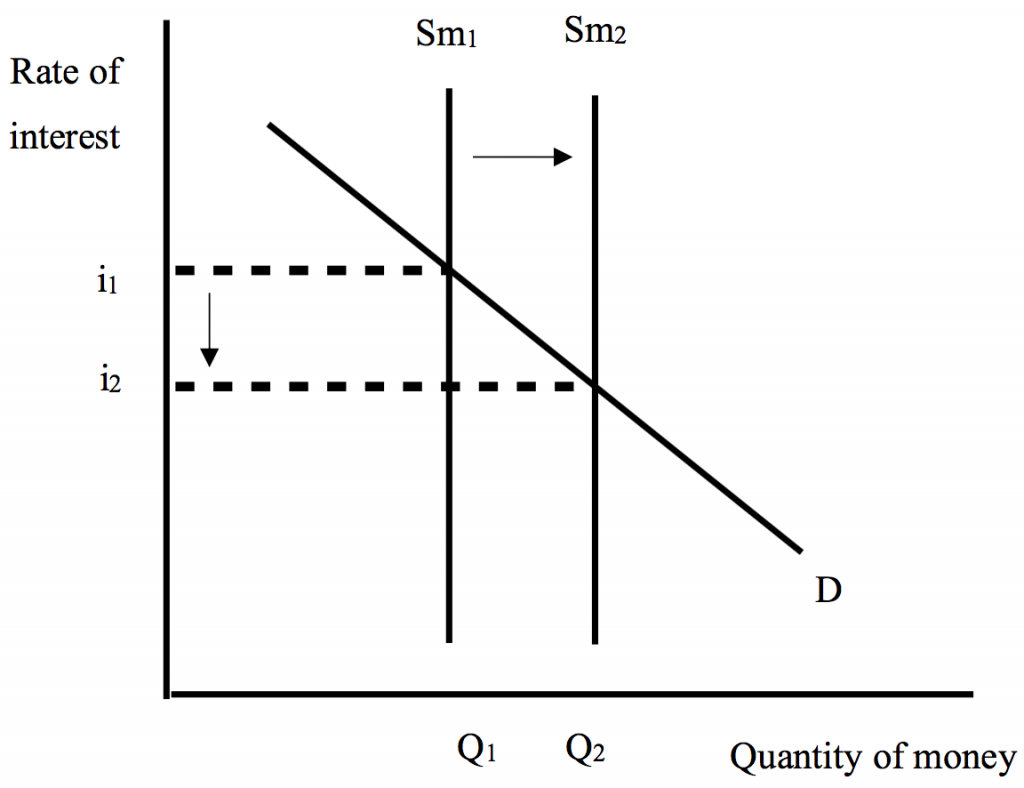

The Russian central bank claimed that progressive decrease in interest rate could be helpful to pull the rate of inflation of the Russian economy back to target. On one hand, lowering interest rate is a monetary policy that can be useful affecting aggregate demand. Through increasing the money supply (from Q1 to Q2), central bank can manipulate the domestic interest rate (from i1 to i2). This can be shown in a demand-and-supply diagram (Diagram 2).

Diagram 2

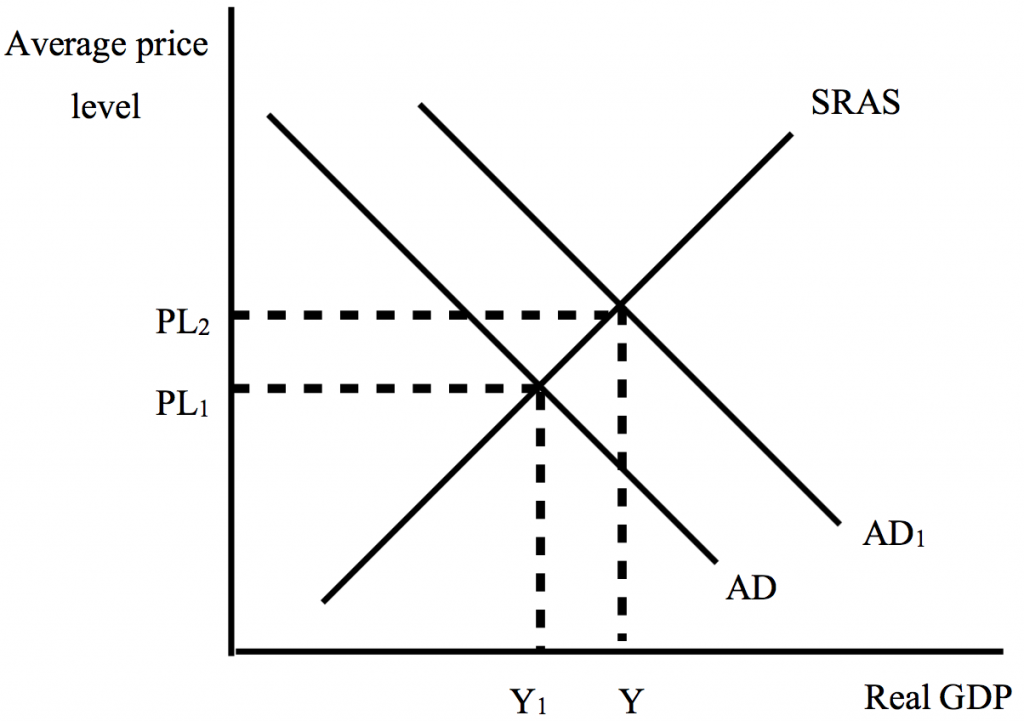

Lowering interest rate will increase the consumption on goods and services because consumers are more likely to borrow money to do purchase if loans are cheaper. Likewise, lower interest rate also stimulates firms to increase their investment. Both consumption and investment are components of aggregate demand. Aggregate demand will increase (from AD to AD1) and GDP output will increase (from Y1 to Y). This is shown in Diagram 3.

Diagram 3

On the other hand, monetary policies may be ineffective in dealing with this stagflation. Monetary policies are demand-side policies. The Russian inflation, however, is a cost-push inflation where the cost of production is not largely affected by interest rates. Moreover, this policy may also lead to higher price level in the Russian economy (from PL1 to PL2) without increasing output, making the stagflation worse.

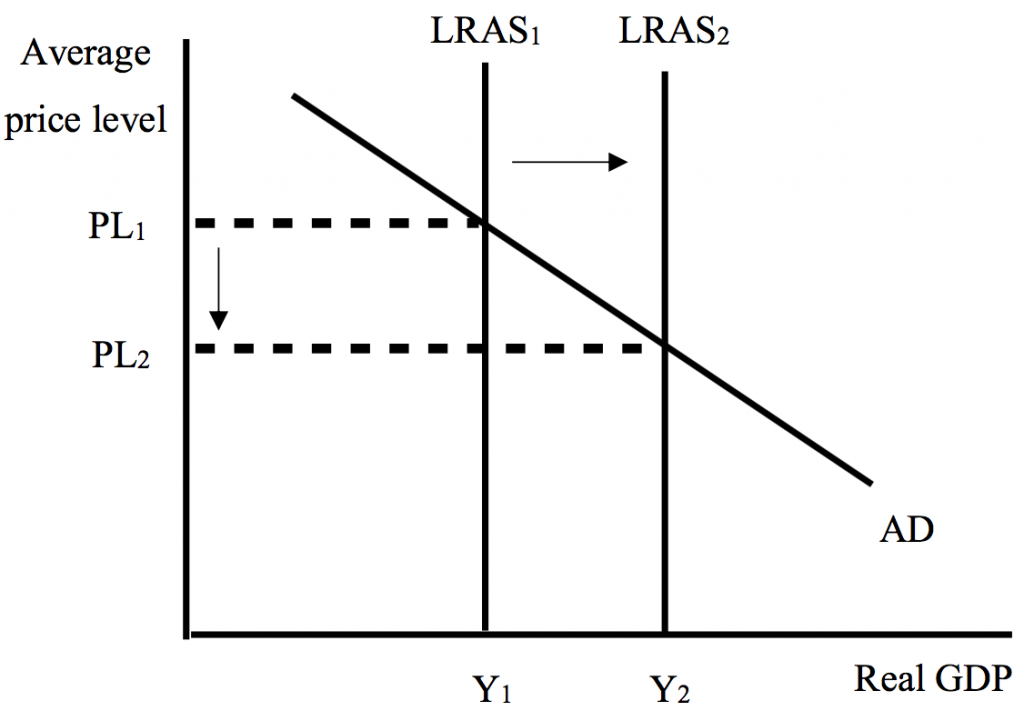

To encounter this problem, it may be more useful for Russia to use supply-side policies. These policies can increase the long-run output (from Y1 to Y2), shifting the long-run aggregate supply curve from LRAS1 to LRAS2. Therefore, there will be a decrease in price level from PL1 to PL2. This is shown in Diagram 4.

Diagram 4

The government could achieve that by improving the quality and quantity of factors of production. For instance, it can directly provide free education and training programs, which will improve the quality of labor and lead to lower structural unemployment since more population will be able to work. Structural unemployment means people who are seeking for jobs but have not found any because of lack of opportunities. This helps to shift the long-run supply outwards. In addition, since Russia’s stagflation is caused by high cost of production, the government can also provide subsidies, infant grants and lower corporate taxes to encourage productivity.

However, supply-side policies rely on government budget, and there will be opportunity cost. For example, cutting business taxes will reduce government revenue, and money spent on subsidizing producers may be instead used on new infrastructures. All in all, more time is needed to check whether these policies will take effect in Russia.